A recent Politico article highlighted how in many states Americans For Prosperity is getting more involved at a local level, with Ohio supposedly being one of them.

In the article, Americans For Prosperity-OH State Coordinator Eli Miller throws down the gauntlet in sending a stern warning to elected officials in Ohio thinking about raising taxes...

Eli Miller, who runs AFP’s affiliate in Ohio, said that no election is too localized to send a message to political leaders up and down the ballot.

“At any level — the local, the state, the federal — you’re going to hear from us. If you don’t want to hear from Americans for Prosperity Ohio, don’t raise taxes,” Miller said. “We fight at all levels.” (Emphasis Added)

After drawing this line in the sand, AFP-OH set in motion to fight a 1% tax increase in the City of Gahanna, OH. Overwhelmingly rejected by voters in May 2013, and with city officials trying to pass it again in November 2013, Eli personally weighed in on this proposed tax increase...

After drawing this line in the sand, AFP-OH set in motion to fight a 1% tax increase in the City of Gahanna, OH. Overwhelmingly rejected by voters in May 2013, and with city officials trying to pass it again in November 2013, Eli personally weighed in on this proposed tax increase... "Many families in Ohio have been forced to get by with less during these difficult economic times. They have managed to make difficult cuts. They should be able to expect the same of the people they elect to represent them and spend their hard-earned tax dollars."

And after being contacted by Franklin County residents to help fight a tax increase for the Columbus Zoo, in attracting national media attention, AFP-OH was again on the front lines battling this tax increase.

Again leading the charge, Eli Miller, like Tarzan swinging down & coming to the rescue in a "King of the Jungle" moment (sans the Tarzan yell & loin cloth) again restates AFP-OH's dedication to local level issues and fighting the proposed Zoo tax increase...

It's all part of the plan. Although AFP is a national organization, its Ohio state director, Eli Miller, told WOSU that his group will be "engaged in local issues, in state issues, on federal issues."

"There is no issue we won’t get involved in if you’re going to raise taxes." Which is exactly what AFP was designed to do. (Emphasis Added)

In continuing doing what "AFP was designed to do," upon hearing the calls from residents in Upper Arlington, AFP-OH & Eli immediately jumped in the fray to also battle this local income tax increase....

However, Eli Miller, state director for Americans for Prosperity Ohio, said in a press release that his organization has received "numerous phone calls and emails from Upper Arlington residents expressing great concern" about the proposal.

"We believe firmly that increasing the income tax can hurt economic prosperity and that taxpayer money should stay in the pocket of the taxpayer rather than the city as often as possible," Miller said. "We agree with so many local residents who seem to be saying that raising the income tax just does not make sense."

“The taxpayers of the county have to come before bigger government and basketball arenas,” State Director Eli Miller said in a news release. “Taxpayer money should stay in the pocket of the taxpayer rather than the county as much as possible. We agree with so many local residents who seem to be saying that raising the sales tax at this time just does not add up.” (Emphasis Added)

Faced with growing opposition from two local grassroots groups started to fight this sports arena tax, along with AFP-OH's stated opposition, Summit County officials removed the sports arena funding from the ballot measure.

Giving credit where credit is due, in the above instances, AFP-OH under Eli Miller's direction backed up his gutsy statements of, "If you don’t want to hear from Americans for Prosperity Ohio, don’t raise taxes,” and "There is no issue we won’t get involved in if you’re going to raise taxes."

Unfortunately Eli's tough macho talk about fighting taxes at all levels in Ohio fell silent when it came to facing the big daddy of boondoggle taxes some local voters were facing in 2014 - the Sin Tax Extension in Cuyahoga County.

The history of a Sin Tax on cigarettes & alcohol to fund new sports stadiums in Cleveland dates back the early 1980's. Being pushed hard by corporate leaders & elected officials, it was initially rejected by Cuyahoga County voters in 1984. Eventually a 15 year Sin Tax was passed (51%) by voters in 1990 and was renewed for another 10yrs in 2005.

The Sin Tax funding for the stadiums and arenas for the Browns and Indians and Cavaliers was set to expire in 2015. Seeing that this taxpayer trough for stadium financing was going to run dry, Cuyahoga County officials and corporate leaders put the wheels in motion to keep this river of public revenue (Corporate Welfare) flowing for another 20yrs.

Raising over $350 million to date from its initial passage in 1990, the proposed 20 year Sin Tax extension is projected to raise another $260 - $300 million. At a total collective cost of close to $650 million -- the Sin Tax extension easily dwarfs the Summit County / University of Akron proposed $74 million publicly funded arena & Columbus Zoo tax that Eli & AFP-OH vigorously opposed.

In initially signaling their commitment to fighting the behemoth Sin Tax extension, AFP-OH fired a warning shot across the bow by issuing a statement concerning public input on the Sin Tax....

“If the Cuyahoga County Council truly wants input from the taxpayers of the county, as County Council President C. Ellen Connally has suggested they do, then these hearings should be held at times when taxpayers can attend,” said Eli Miller, Americans for Prosperity Ohio State Director.

“An issue this important deserves to be debated and discussed with as large an audience as possible,” continued Miller. “We urge the Cuyahoga County Council to demonstrate their commitment to hearing from the taxpayers and increasing government accountability by moving these hearing times.” (Emphasis Added)

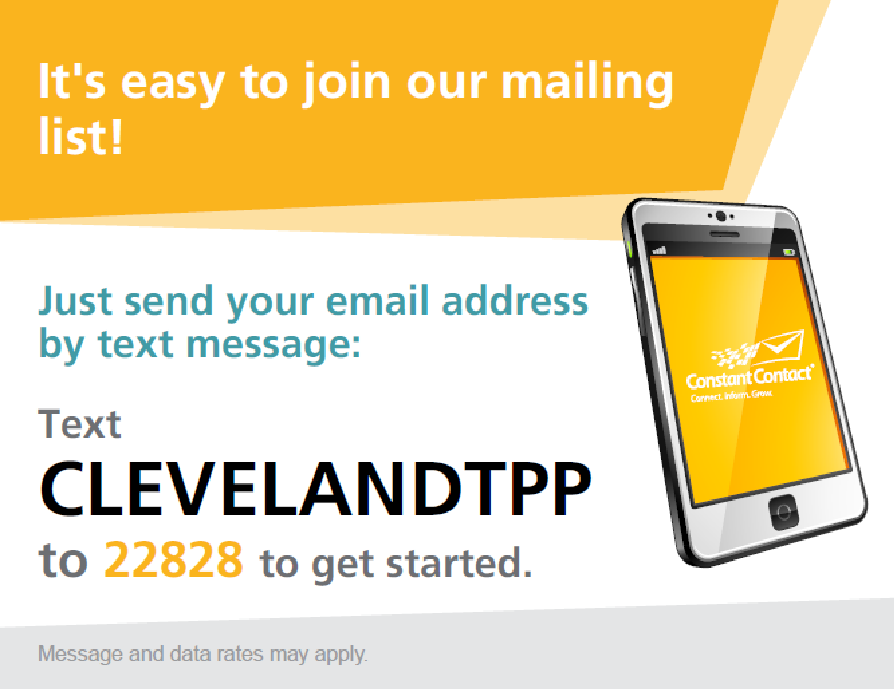

Confirming their commitment to fighting the Cuyahoga County Sin Tax extension, AFP-OH had a Field Coordinator starting to organize opposition to the Sin Tax, was explicitly expressed by Eli to myself in a phone conversation and was reaffirmed by Matt Patten (AFP-OH Asst. State Coordinator) in a January 2014 meeting held at the AFP-OH HQ in Columbus attended by Marianne Gasiecki (Mansfield TPP) and myself, Ralph King (Cleveland TPP), as State Coordinators for Tea Party Patriots.

With Eli Miller & AFP-OH on board to fight the Sin Tax extension, this set the stage for the mother of all tax fights in Ohio! Eli Miller & his AFP-OH to battle against Cuyahoga County's Kings of Corporate Welfare pushing the Sin Tax extension -- The Greater Cleveland Partnership (GCP).

Using their money & influence as the largest Chamber of Commerce in Ohio and one of the largest metropolitan chambers of commerce in the nation, the GCP had the GOP controlled Ohio Legislature add in a last minute provision to Governor Kasich's budget bill (HB 59) that would give Cuyahoga County the option to extend the Sin Tax beyond the scheduled 2015 expiration....

"We are fortunate enough to have three professional sports facilities in our city," said Marty McGann, the partnership's vice president of state and local governmental affairs. "They are getting older and the goal of this organization was to ensure that they are maintained."

Without the budget amendment, the tax would have expired in 2015 and could not have been renewed under a state law that had been in place since 2008, McGann said.

McGann said Cleveland Mayor Frank Jackson and Cuyahoga County Executive Ed FitzGerald were informed of the measure as the Greater Cleveland Partnership worked with lawmakers to add it to the budget.

Seeing the Tea Party, Occupy, conservative & progressive grassroots activists teaming together with AFP-OH against the Sin Tax and the perfect storm of defeat heading their way, the cabal of corporate charlatan's at the Greater Cleveland Partnership played their wild card.

Then, almost like am unruly child being spanked, sent to their room & told to behave, AFP-OH under Eli Miller's direction pulled out of the Sin Tax fight with just a simple, "we cannot be involved with fighting the Sin Tax."

So why would Eli & AFP-OH take their marbles and sit out the largest tax fight in Ohio? Could it possibly be his direct and familial ties to the Greater Cleveland Partnership, the corporate cabal of charlatan's pushing the Sin Tax?

The Greater Cleveland Partnership, which embodies the definition of corporate cronyism, was an idea spawned by Sam Miller & Albert Ratner of Forest City Enterprises in 2002 and started in 2004. Sam Miller & Albert Ratner are, respectively, the grandfather & uncle of Eli Miller.

Getting his start working for his grandfather & uncle at Forest City Enterprises in Cleveland. Eli moved up the ladder and went on to work for Speaker John Boehner in 2009 and the Romney campaign in 2012.

Eli became the Ohio State Coordinator for Americans For Prosperity in May 2013 - the same month & time frame his grandfather & uncle made numerous donations to Boehner, the National Republican Congressional Committee along with other "establishment" Ohio Republicans historically supported by Americans For Prosperity in Ohio.

In May 2013 Sam Miller made donations to Speaker Boehner totaling $4,200 and a $5,800 donation to the Boehner controlled, National Republican Congressional Committee.

While Eli's uncle Albert Ratner, during a 30 day period of Eli becoming AFP-OH State Coordinator, made a series of donations to Ohio's dream team of establishment RINO's totaling over $14,000 to Speaker John Boehner, Sen. Rob Portman, Rep. Jim Renacci and Rep. Dave Joyce.

How's that for buying control and undermining any conservative grassroots opposition?

Not convinced yet? Stay tuned - you will be! This is the first of a series and you can be sure - there is more to come! Next up, the Common thread that is rotten to the Core!